The Revised GST Slabs (GST) is the biggest tax reform in India, introduced to unify the indirect tax system. Since its launch in 2017, GST has been regularly updated by the GST Council to reduce complexity and provide relief to businesses and consumers.

In the 56th GST Council meeting on September 3, 2025, a historic decision was made to simplify and Revised GST Slab into just three slabs – 5%, 18%, and 40%. This move is expected to make tax compliance easier, lower the burden on essentials, and bring more clarity for industries.

Major Highlights of the 56th GST Council Meeting

- 12% and 28% slabs removed to simplify the structure.

- Goods and services reclassified into 5% (essentials), 18% (standard), and 40% (luxury & sin goods).

- Effective from September 22, 2025.

- Focus on keeping food, medicines, and essentials affordable.

- Luxury cars, aerated drinks, and sin goods taxed at 40%.

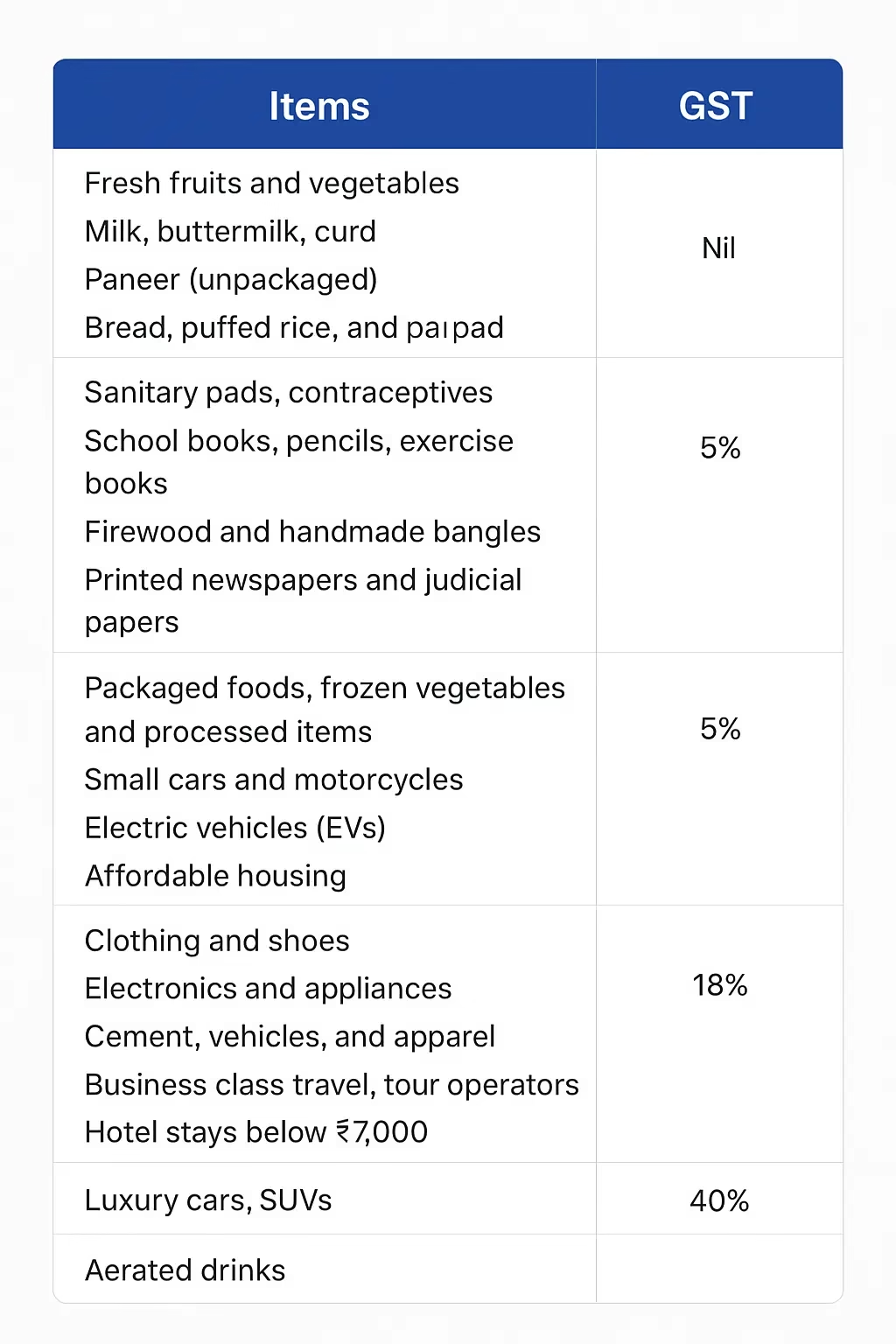

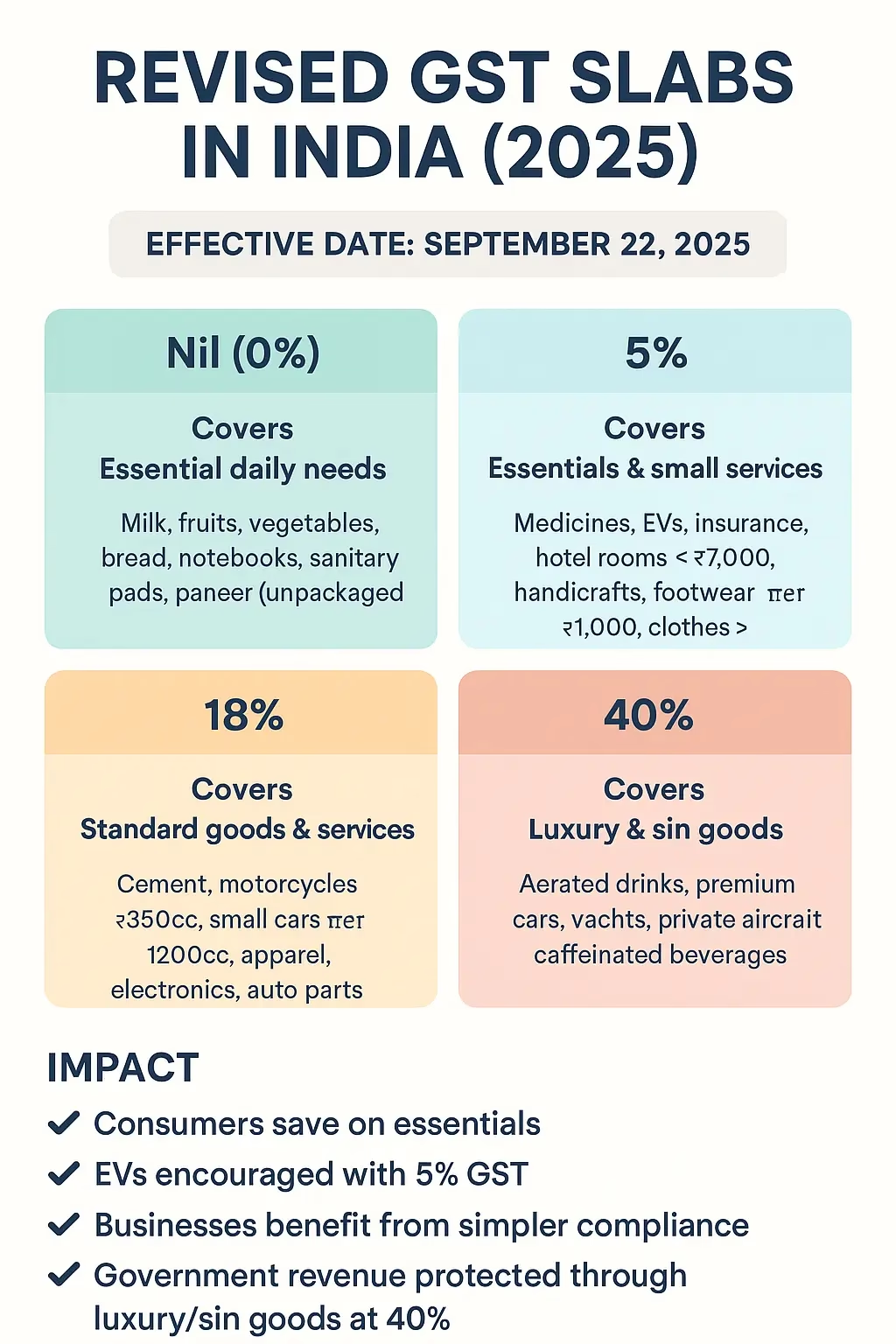

Revised GST Slabs in India (Effective from September 22, 2025)

The revised GST structure has brought clarity by reducing the earlier multiple slabs.

| GST Slab | Category | Examples |

| Nil (0%) | Basic daily essentials | Milk, UHT milk, fresh fruits, vegetables, bread, notebooks, sanitary pads, paneer (unpacked) |

| 5% | Essentials & common services | Medicines, insurance, footwear below ₹1000, clothes above ₹1000, EVs, tractors, hotel rooms below ₹7,000, handicrafts, food items |

| 18% | Standard goods & services | Cement, apparel, vehicles (<1200cc), motorcycles (<350cc), auto parts, electronics, appliances, buses, trucks, gyms, salons |

| 40% | Luxury & sin goods | Aerated drinks, premium cars, yachts, private aircraft, caffeinated beverages |

Nil GST Rate – Relief on Essential Commodities

The government has ensured that several essential household products remain tax-free. This helps lower-income groups and reduces household expenses.

Expected Future Additions to GST

The government may soon include petroleum products, electricity, and land under GST, which could further simplify taxation.

Impact of Revised GST on Indian Economy

The new GST slabs aim to:

- Boost exports by reducing production costs.

- Increase competition and reduce tax evasion.

- Provide relief to middle-class households by keeping essentials cheaper.

- Create a uniform tax regime that is simpler for businesses.

Conclusion

The 2025 GST revision marks a big step toward a simpler, fairer, and more efficient taxation system in India. With fewer slabs, essential goods at Nil or 5%, and luxury/sin goods at 40%, the government has struck a balance between affordability and revenue generation. Businesses can now enjoy easier compliance, while consumers benefit from lower prices on daily essentials.

FAQs on Revised GST Slabs (2025)

Q1. What are the new GST slabs in India (2025)?

Ans: The slabs are Nil, 5%, 18%, and 40%.

Q2. Which items are tax-free under GST ?

Ans: Milk, bread, fresh fruits, vegetables, sanitary pads, books, and some traditional foods.

Q3. What is the GST rate for cars in 2025 ?

Ans: Small cars – 18%, Luxury cars – 40%, EVs – 5%.

Q4. Is GST charged on loan EMIs?

Ans: No, GST is charged only on processing and service fees, not on EMIs or interest.

Q5. What is the GST rate on gold jewellery?

Ans: Gold jewellery – 3%, Making charges – 5%.